Previously, we covered some high-level budget topics. We mentioned that your Net Budget line should equal 0. This is important because it means that you assigned a job to every dollar that you earn for the month. Note: even assigning money to go to a savings account or under your mattress still satisfies the requirement of assigning a category to every dollar that you expect to earn. In fact, savings should be included in your budget. We will discuss some savings strategies in another entry. For now, let’s dive deeper into the budget. To get you thinking more about your own personal situation, let’s revisit the budget we discussed previously and go line by line.

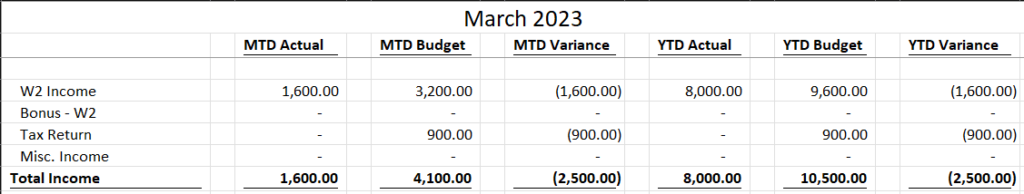

Notice above that we have broken out different lines that roll-up to Total Income. You might not work a W2 job, if you work a contracting job or multiple contracting jobs, you can enter those separately here. It is important to get granular with your budget. This allows you to keep proper track of any income in or expenses out. That is why we included a separate line for our Bonus and Tax Return. If you get a bonus in your job, you could likely plan for that too because it is likely you know what that value would be before it is deposited into your account. Misc. Income can be a catch all for income that might not recur often, such as winnings from a fantasy football league or March Madness bracket. You might not know when that would come in, so you could update that line when you receive the income. It is important to not fall into the “I have extra income this month, so I do not need to keep track of it” trap. Keep track of it. Do not let that money go unassigned. Develop this habit now so that you can reap the benefits of budgeting in the long run.

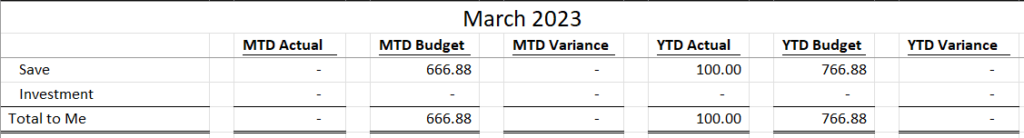

The next line that we will talk about is the Total to Me line. This line should be money that you receive yourself. You can save this money into a savings account, you could invest it in whatever investment medium you want to invest in, you can bury the money in your back yard, stash it under your mattress – whatever you want to do with it. Just be sure to have some money being paid to yourself. This is important. Always try to have something here. I understand that being underpaid exists in this world but think about this in terms of your debtors. If you do not pay your debtors on time, they will complain and possibly harass you to pay them. If you do not pay yourself timely, you are unlikely to complain and just have the money go out to your bills. Even if it is a dollar or any extra income earned from a side hustle, try to have a nest egg for yourself. We will discuss some savings strategies later.

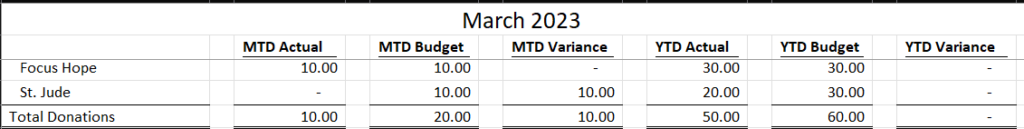

The next section in our budget is a Total Donations line. It is important to donate to organizations that are legitimate and fit your donation goals. You can break it out by entity, like the above, or just have one line for Donations. This is an important aspect of your personal finance education and budgeting process because there are so many people that do rely on these institutions and every little bit can help. I highly recommend researching non-profits in your area and doing what you can to help, whether it be through your time (volunteering), donations, or just spreading the word.

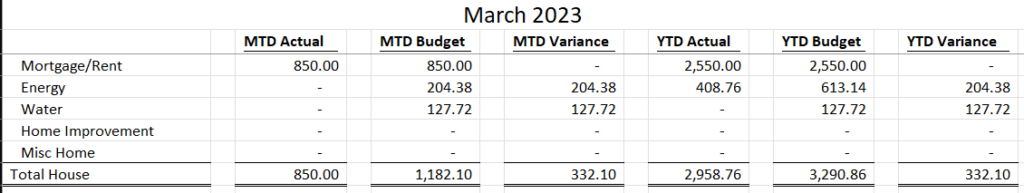

Next, we have the Total House line. We went into detail on this previously. However, I will mention that it is important to keep track of all of the expenses that go into your housing. You can use the name of the company that you pay your mortgage or rent to instead of having a vague line like “Mortgage/Rent” (i.e. if you pay a mortgage to Chase and want it to say Chase instead, do that). Whatever works best for you. I only hope to provide you with some inspiration for ideas on your own budget.

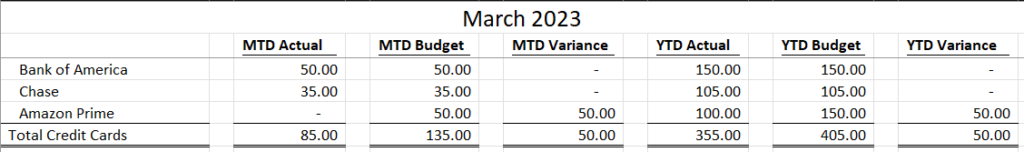

Credit cards are another animal that we all tend to accumulate debt to and carry a monthly payment for an extended period of time. Credit cards absolutely need a budget so that you can pay off your debt as soon as possible while keeping track of what you spend on these credit cards. I think that some people lose sight of the expenses they put on their credit cards because they might be with another bank or credit union that is not the one that has your main checking account. Having these lines in your budget will help keep you on top of your expenses to your credit card. If you notice that you are constantly budgeting to these lines, you will have to figure out how to stop relying on your credit cards. We can talk more about these strategies later. I like to break them out by credit care because some banks have endless amounts of credit cards (e.g. Chase currently has the Amazon Prime card). This way you are getting as granular as possible with your credit cards.

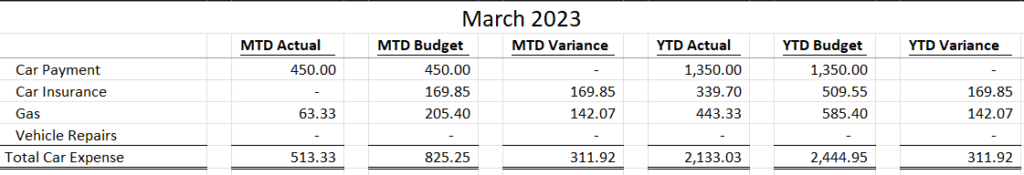

Cars are really expensive now a days and it is possible that you might need to get a loan to get a car or take out a lease. Keep track of that expense here. Here are some common car related expenses, car insurance, gas, vehicle repairs, license plate tag renewals/registration, car wash. Fit this to your own needs – you might live in an area with great public transport. Keep track of any expenses going towards your transportation here, such as any bus passes, subway passes, etc. If you do have a vehicle, you know that vehicle repairs tend to “pop-up” and are not planned in advance. This is why you should budget frequently so that you can edit your budget to account for any changes that might be necessary to your budget throughout the month. More on that in the next post.

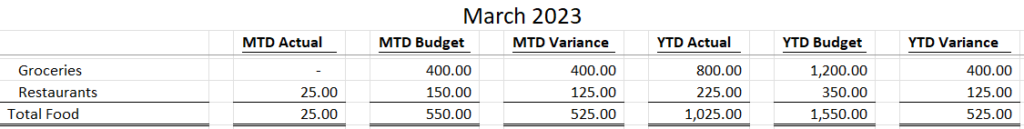

Food is wonderful. However, we do need to keep track of what we spend on food. Breaking out what you spend on groceries and eating at restaurants can be helpful for you to get a handle on your eating habits. If you want to make more of your own food instead of going out often, you can set that goal in writing with your budget. If you work 60 hours a week and have little time to actually cook, you might be eating at restaurants more. So design your food budget to fit your lifestyle and goals.

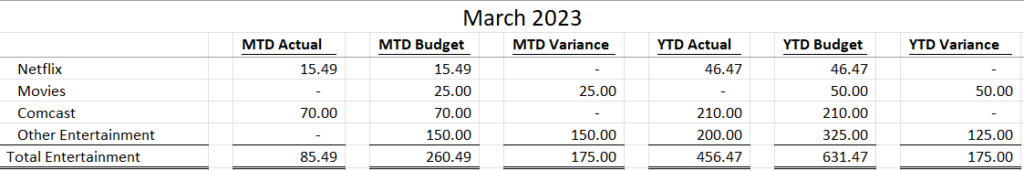

The last line that I will talk about today is the Total Entertainment line. This is another important line that I think is easy for people to let go without paying close attention to your expenses that relate to entertainment. We should break down entertainment as much as we can, break out your Netflix, Disney+, Comcast, WOW, etc. into separate lines. This way you can also keep track of when these companies raise expenses on you without you noticing too. They do notify you but sometimes those notifications go straight to the trash. Ha.. If you have any recurring entertainment, put it in its own line under this category. Do not keep track of any kind of date nights to only use how much you have spent on your significant other during an argument. That would never ever ever ever work well in your favor. But you should keep track of that expense so that you plan money to it (you do not have to plan the event here obviously) and it shows that it is an important thing for you to do with your significant other.

So that should give you some ideas to begin building out your budget categories. Know yourself, know what you like, and budget to that. Make sure that you are not overspending. Next time we will talk about budgeting frequency and how to read the variance columns.

Let’s get to work.

Disclaimer: I am not a financial advisor. The content on knowxchange.com or “this site” are for educational purposes only and merely cite my own personal opinions and experiences. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know and understand that all investments involve some form of risk. There is no guarantee that you will be successful in making, saving, or investing money. Additionally, there is no guarantee that you won’t experience any loss when investing. Please seek the advice of a financial professional and do your own research.