Do you want to know approximately how many years it will take for you to approximately double money on an investment? Enter the Rule of 72.

What is the Rule of 72?

The Rule of 72 is a formula that one can use to estimate the number of years required to double invested money at an assumed constant annual rate. Additionally, because math allows us to manipulate the formula, we can also use the Rule of 72 formula to derive a formula to calculate the approximate annual rate of return required to double money on an investment in a provided number of years. This formula is an approximation. It is useful because we can often do the quick math on a calculator – or round in our heads for those that can do great mental math. Our previous post on Compounding Interest offers similar formulas in the Excel workbook and Google Sheets download. However, we wanted to share this as a quick tidbit to enhance the scope of the financial education foundation that we are building on knowxchange.com.

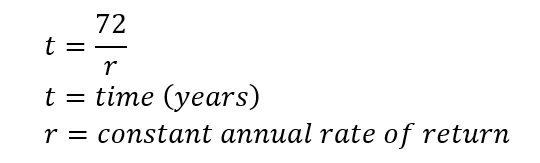

So what's the formula?

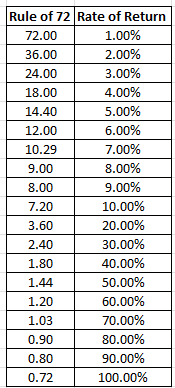

Using the above formula, we can arrive to the following table:

If you read the above table, the Rule of 72 suggests that a 1% constant annual rate of return will take approximately 72 years to double money on an investment. Alternatively, the Rule of 72 suggests that a 9% annual rate of return will take approximately 8 years to double money on an investment.

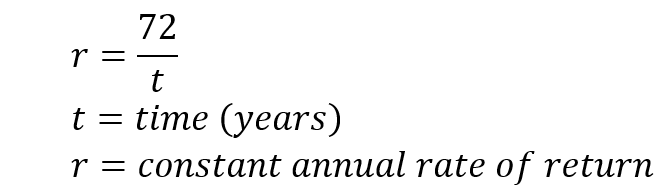

If we manipulate the formula by multiplying both sides by r and dividing both sides by t, we can arrive at the following:

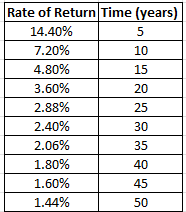

Using the above formula, we can arrive to the following table:

So that is the Rule of 72. Understand that this is an approximation and it only relates to compound interest. It does not apply to simple interest. Additionally, it is not realistic to assume a constant and equal rate of return on investments throughout the life of the investment. Markets fluctuate and rates change. Additionally, this does not take into consideration any fees or taxes associated with investing, which can alter the results. To obtain advice that is applicable to you and your life, consult with a financial planner in your area.

It is my hope that reviewing this information with you will only increase your confidence as you progress through your financial education and allow you to feel more confident when you meet and work with financial professionals.

Disclaimer: I am not a financial advisor. The content on knowxchange.com or “this site” are for educational purposes only and merely cite my own personal opinions and experiences. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know and understand that all investments involve some form of risk. There is no guarantee that you will be successful in making, saving, or investing money. Additionally, there is no guarantee that you won’t experience any loss when investing. Please seek the advice of a financial professional and do your own research.