Welcome back! The previous two posts focused on building a budget, which hopefully inspired you to create your own budget. Today’s post will end our initial journey into the world of budgeting, for now.

So, we have built a budget, but how frequent should you be updating our budget? The true answer will depend on your personal situation, but here are two ideas to consider:

- Set your budget monthly. Do this either at the beginning of the month that you are budgeting for or at the end of the previous month. You set this budget once per month in its entirety and then fine tune it during the month as you check-in with your budget.

- Update your actual expenses versus your budget weekly. Get into the habit of doing this weekly because it will help you take control of your spending habits and allow you to build out your own systems to streamline your budgeting process. Eventually, you might be able to do this every other week. Checking in with your actuals versus budget is a great way to fine tune your budget during the month. For example, if you budgeted $100 to vehicle repairs for the month, but the bill came out to be $50, you could reduce the budgeted amount to match the actuals and then add that $50 to another line. Assign a category to that $50, do not let it go unassigned because that will throw off your analysis as you check in throughout the month.

It is my hope that these steps will help you develop strong budgeting habits. It is one thing to keep track of your finances mentally, but it is entirely different to see your spending habits on a screen or a piece of paper. Remember, you are the CEO of your life, treat your finances like a business by really scrutinizing your expenses and keeping track of your actuals versus budget.

Budgeting consistently will allow you to reference your historical budgets in the future, which can be a lot of fun. If you started budgeting today, by this time next year, you could compare your spending during the same month for both years. This is also known as Year-Over-Year (YoY) analysis. This can be helpful to keep track of any annual expenses that you might have, which can also allow you to see how much those annual expenses change year to year. Some final thoughts on this: after a year you could add a YoY column, or you could add a 12 month rolling average calculation, which can be helpful to compare your current MTD spending against your average for the previous 12 months. We can cover that later because it can get quite intricate.

The last thing that I want to cover today is something that could have been discussed during the first two posts, but I wanted to get you to focus on building out the categories for the budget without making the posts too long. So let’s talk about the variance columns.

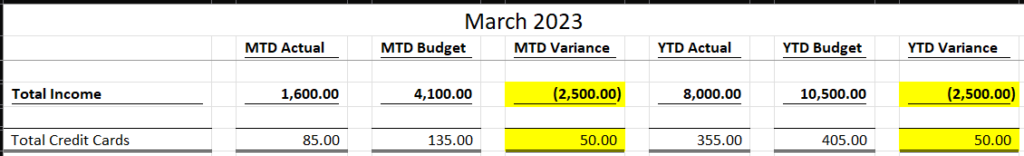

In the above image, you might notice that there are two obvious differences between Total Income and Total Credit Cards besides the formatting. The MTD and YTD Actuals for both lines are less than the MTD and YTD Budget, but the variances show as different numbers. Why is that? The income shows as a negative number and the expenses show as a positive number. This means that we have currently earned less than what we have for the month, which is not great, hence the negative number. Similarly, we have currently spent less than what we have budgeted for the month, which is a good thing, hence the positive number.

That might be hard to conceptualize, so let’s look at it another way:

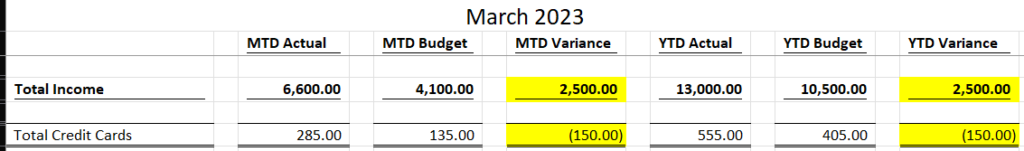

Notice now that our MTD and YTD actuals are actually greater than our MTD and YTD budget. This means that we have earned more income than we previously expected, which is a good thing. Alternatively, we have spent more on our credit cards than we previously expected, which is not great. Therefore, the calculations for income should be:

{MTD/YTD Variance = (MTD/YTD Actual) – (MTD/YTD Budget)}

Similarly, the calculations for expenses should be:

{MTD/YTD Variance = (MTD/YTD Budget) – (MTD/YTD Actual)}

These might be obvious calculations, but I wanted to make sure that we covered them to round out building out an entire budget from scratch. Both of these calculations are already provided to you in either of the two below downloads. I wanted to make sure that you understood what these calculations are actually telling us.

Of course, as I mentioned previously, there are many sites and applications that streamline a lot of this for you. If that is something that you want to do, by all means use them. But the steps will be similar because you will still have to design and create a hierarchy of categories to assign your income and expenses. Just do not passively look at your budget. Get in there and really keep track of your expenses.

Disclaimer: I am not a financial advisor. The content on knowxchange.com or “this site” are for educational purposes only and merely cite my own personal opinions and experiences. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!