Hello world!

I am writing you today because I realize that we need to do better with our financial education. Financial gurus exist, financial planners and advisers exist, but these can often be intimidating to the normal person. So I am here to share knowledge and experience that I have acquired over the last decade to try and help exchange some knowledge with anyone that might need it. I believe this information should remain free, therefore, I will keep the blogs free. It is important to note that I am not here to provide financial advice and nothing that I post here should be construed as financial advice. If you require financial advice, please seek the help of a professional in your area. The purpose of this blog is to share some experience, logical breakdowns, and other strategies that can help you come up with new ideas for your own finances or life. I wish that I had been taught these things in my years of school, but learning from others is a great way to continuously improve. So that is what I am going to try to do for you with this site.

The very first idea that I am going to cover is a budget. A budget is very important to building your financial education. Look, I understand that there are loads of products out there that have automated the transactional data dumps for you to pull in and compare what you have spend against what you have budgeted for specific lines. There are some folks that might not be comfortable with that and might want to build out their own budgets. This is why we are starting with the budget. I believe that it is beneficial to get into the weeds with your finances, at least at the beginning of building out your own budgeting systems. You are the CEO of your life and you should monitor your finances like a CEO would a company’s finances. This means creating an income statement for your budget. You can create a balance sheet, but that can come later. Let’s get the income statement down first and then we can move on to the balance sheet.

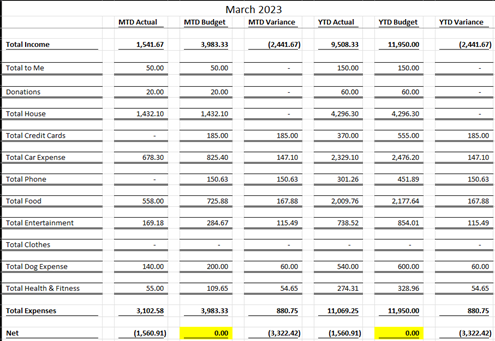

Your budget should look like the below image. For the below image, note that MTD stands for Month-To-Date and YTD stands for Year-To-Date. MTD is a period that begins with the first day of the month up until the current day of the month. The budget is set for the entire month, so the MTD budget should change minimally over the course of the month – only change the budget amount to account for any overspend on a specific line. MTD actuals can change up until the last day of the month. Similarly, YTD is a period that begins with the first day of the year up until the current day of the year. The YTD budget will be the budget that has been set for the current month plus all the previous months since the beginning of the year.

Notice the highlighted cells on the “Net” line. These cells are the difference of “Total Income” and “Total Expenses”.

Notice how these show as “0.00”. This is a good thing, we want our net budget to equal zero because this means that we have assigned a category to every dollar that we expect to earn during the month.

This is a high-level view of a budget. Your lines might look different, i.e. you might not have a dog.

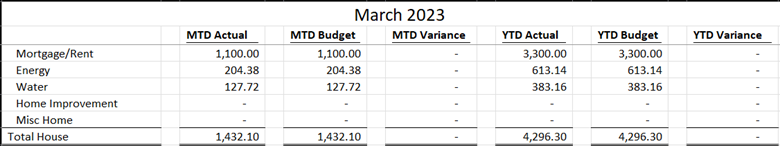

The lines that you see there have been grouped with lines under each total. It is important to get as granular as possible with your budget. Let’s dive into the Total House line, below.

Notice that we have Mortgage/Rent, Energy, Water, Home Improvement, and Misc Home that all roll up to Total House.

This is as granular as this example needs, but perhaps you might have a Home Equity Loan or Home Equity Line of Credit (HELOC) that you want to add as a separate line. You would add anything that you expect to be an expense to your home to roll up to Total House and use the Misc Home line as a catch all for any unexpected expenses. A miscellaneous line is helpful, but do not let any repetitive expenses hit this line, create a separate line.

I understand that this is difficult for people that have variable income. However, variable income does not preclude you from having a budget. You still have to make payments on whatever bills that are due, and you still have to eat or save up for anything that you might desire. You should always be budgeting, and you should check in with your budget at a minimum of every other week. This way you can keep track of your expenses vs. what your budget is and then make any adjustments to account for either over or under spending on a specific line. For example, if you budgeted $0 to Home Improvement for the month, but you actually had to go spend $50. Your month to date variance will be ($50.00) overspend. So you will need to find a way to beef up the Home Improvement line by $50 for your budget that month. We will cover more of this later.

If you would like a little bit of direction, you can download the Excel file below or access the Google Sheets file below. These are already pre-populated with instructions and formulas to help you out. Note: You will have to copy the Google Sheets file to your own drive to edit it.

Disclaimer: I am not a financial advisor. The content on knowxchange.com or “this site” are for educational purposes only and merely cite my own personal opinions and experiences. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!

This is guaranteed to change your life. MRB is a king!