Welcome back! Let’s talk about interest today. Today’s post will cover examples along with an Excel workbook and Google Sheets download. It is important to note that these examples are approximations, and nothing contained within these examples should be construed as exact calculations nor financial advice. For some reason, various technologies in the banking world model cash flows slightly differently, which can lead to some discrepancies between the following and what is offered at the bank or credit union. I will do my best to get us as close as possible, but your institution might vary slightly. It is my hope that this conversation will boost your confidence so that you can approach a banker with a better understanding about interest.

What is interest?

Interest is a percentage of a balance that is either charged or paid to you over a period. The interest rates that you see on financial products at your bank or credit union are rates that can be traced back to benchmark rates set via a governing institution that wants to govern economic growth or inflation. For the United States of America, that governing institution is known as the Federal Reserve, a.k.a. The Fed. If you live in the United States, you might have heard that the Fed is lowering rates, or the Fed is raising rates. When rates are low, this means that the cost of money is low, which encourages borrowing and spending to support economic growth. When rates are high, the cost of money is high, therefore borrowing and spending tighten up. We typically see an increase in rates during times of high inflation. If this topic interests you at all, let me know, but for now we will leave the information at that to cover how interest rates are used to pay you interest on a deposit account or charge you interest on a loan.

The interest rate that you see on your deposit account or loan is typically the annual rate. There are two terms for annual rates, one is annualized percentage yield (APY) and the other is annualized percentage rate (APR). The APY shows the annualized rate of return (interest) on an investment including the effect that compounding interest has on an investment. If you are looking to open a savings account or other investment account, you want to focus on the APY. Compounding interest is the interest that you earn on your balance plus any accumulated interest from pervious periods (a.k.a. interest earned on interest). APR shows the total cost of borrowing money. This is an important distinction because the interest rate on a loan might be 5% and the APR could be 6%. The APR includes any initial or recurring fees. When shopping around at banks, the APR can show you which institutions might have the true best products for you in the long run. For this post, we will focus solely on the interest rate of a loan since that is likely the bulk of your fees. We can include a calculator for APRs later.

Why do banks or credit unions pay interest?

Banks and credit unions use that money to lend to others. Paying you interest on your deposit balance is the banks way to incentivize you to give the bank more money so that the bank can use that money to originate loans.

Ok, why do they charge interest?

Loans keep these institutions in business. They need to be able to lend money out at a premium so that they can pay back their shareholders or members via interest on deposits and maximize their own profits. Credit unions might not be looking to maximize their own profits given the fact that they are generally considered non-profits, but they do want to maximize the return for your deposit. Recall a big difference in credit unions and banks revolves around terminology for you – at a bank you are a customer and at a credit union you are a member. Deposits show up as liabilities for banks and equity for credit unions on their respective balance sheets. It is easy to go down a tangent here, but I thought that it was important to highlight this fact here.

How does it work?

Typically, we need to use those annualized rates, discussed above, to calculate a daily interest rate. It needs to be a fair way to assign interest for everyone. There are a few ways to calculate interest, the most common that I have seen are below:

- 30/360 – you can calculate your monthly interest here by dividing your annual rate by 12 (30/360 = 1/12). Note: this is a reasonable approximation. This method will use 28 or 29 in the numerator for February on non-leap years and leap years, respectively. Additionally, this method does not use 31 for months with 31 days (January, March, May, July, August, October, and December).

- Actual/Actual – this is slightly more complex than 30/360, this is the actual number of days in the period over the actual number of days in the year, which means that on a leap year the numerator is 29 for February and the denominator is 366 for the entire year and for non-leap years, the numerator for February is 28 and the denominator is 365.

- Actual/360 – here we use the actual number of days in the period over 360. This one is probably the rarest out of the three here.

Why is interest calculated this way?

This is a fair way to assign interest so that it is consistent throughout the life of your relationship with that bank or credit union. Additionally, this allows a bank or credit union to account for leap years, collect interest monthly, or pay interest out at another interval. Just to be as fair as they could be with little to no arguments against the calculations.

Deposits

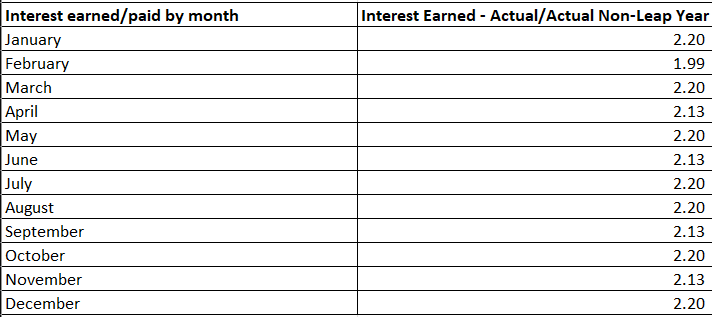

When we calculate our daily interest rate, we have to figure out how to charge or pay you interest. First, let’s look at deposits and assume that a deposit is paid monthly. The interest on deposits is typically given out using your average balance for a given period. For example, assume you average around $550 for 30 of 31 days in March and deposit $5000 on the last day of the month, that might give you an average balance $692 for the month. It makes more sense for the bank to pay you interest on your average balance for the month than the balance at of the end of the month. This is because that is a more accurate representation of your balance for the month. So, what would the payout on that average balance look like for you? Look at the below, this is approximately what you could reasonably expect to earn on a given month with a savings account that has a 3.75% APY and a $692 average balance. Additionally, you might see payouts on your daily balance that is paid out at the end of the month. Check with your banker to see what your interest will look like for your product.

You can look at the Excel file or Google Sheets file below, navigate to the Deposit Account Example and play around with the highlighted cells. This will give you a reasonable way to calculate what you might approximately be able to earn on a deposit account with a given APY using a given interest method. It will not be exact because I have stated that it seems banks and credit unions are rocking their own methods internally, but my calculations should get you close.

Loans

Finally, I will talk a little bit about loans. Interest on loans is basically saying this money costs x%. The interest is calculated using one of the methods I discussed above and then multiplied by your current balance. Financial institutions do not pay you based on the current balance of your deposit, but they will charge you based on the current balance of your loan. This makes sense, right? Think about it, the current loan balance is not as likely to change much throughout the month. If your loan balance does change significantly, it is likely a significant pay down and you would rather pay interest on a significant lower balance than the previous higher balance.

In the downloads below I have a loan example spreadsheet that you could hop into and mess with. The highlighted cells are areas that you could fill out to see just how much interest you can reasonably expect to pay on a loan with a given balance, rate, term, and interest method. If you have any feedback, let us know.

Disclaimer: I am not a financial advisor. The content on knowxchange.com or “this site” are for educational purposes only and merely cite my own personal opinions and experiences. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!