Yesterday, we talked about interest and I mentioned compounding interest in passing, but I thought that it might be beneficial for us to cover that today with some Excel files for you to play around with. Because we are getting into compounding interest, I must reiterate that I am not a financial advisor nor am I a financial planner. Do not construe this information as financial advice or advice in any way. The following post is for educational purposes so that you can see how compounding interest works. If you need financial advice, please seek a financial professional in your area.

What is Compounding Interest?

Compounding interest is a method of calculating interest on an investment or loan that adds the interest earned to the principal balance, resulting in a new principal balance that is then used to calculate future interest. This method means that interest can earn interest, which results in a compounding effect that can significantly increase the principal balance over time. This is a common interest method that you can see on various savings, investments, and loan products.

You might have heard about the cost of waiting to put money into your retirement account using examples such as “if you wait until your 27 years old, you will have to put away $214 a month to reach a $1 million dollar balance in your retirement account to retire at age 67. If you start at 37 you will have to put away $541 as month to reach a balance of $1 million dollars to retire at age 67….” They go on with the examples to show how waiting to save for retirement can really affect your monthly contributions. This is the result of compounding interest. If you read the fine print on those sites with this information, it would read something like “this assumes a 9% annual rate of return compounded monthly, this is not 100% accurate because rates and markets shift, so it would be unwise to assume a 9% return every year, this also excludes any taxes or fees which could affect the overall balance”. Maybe not word for word, but you might see something to that effect. That is all fine, you have to work with a Certified Financial Planner (CFP) to determine a strategy that best fits your needs, but this is for educational purposes so that you can go into your meeting with a CFP feeling more confident in yourself.

Compounding Interest Example

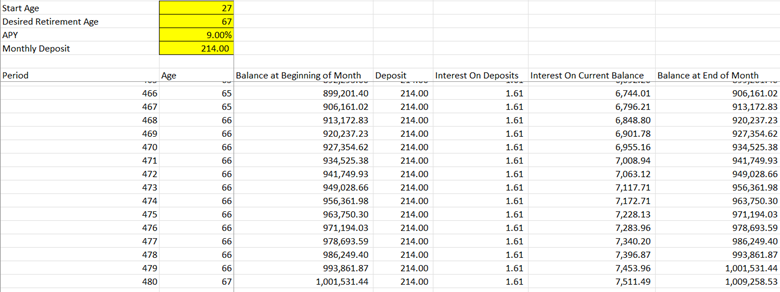

This first example shows the end of the term using the information from the above. The assumptions here are a starting age of 27 years old, a desired retirement age of 67 years old, a $214 a month contribution to the account with compounding interest, and a 9% annual rate of return. Let me reiterate that assuming a 9% annual rate of return works for educational purposes and should not be assumed as financial advice. Rates can change daily, which can affect the overall rate of return. Additionally, this does not take into account any kind of fees or taxes, which can change the overall value of the balance. Please work with a CFP or other financial professional to learn more.

If you notice here, right when you turn 67, the balance is over $1 million. Yay. But what happens if we change the monthly contribution? Let’s change it to $175 a month.

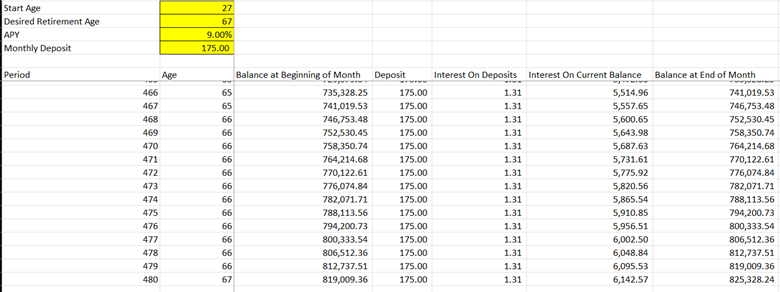

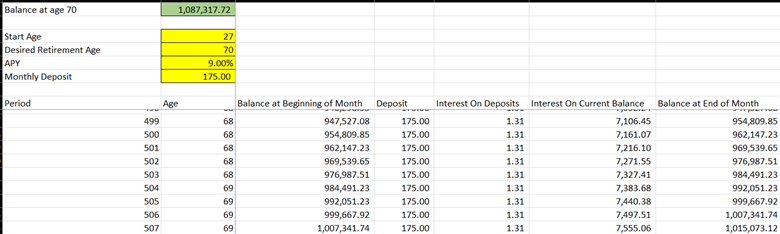

Look at that, the new ending balance is about $180K less at age 67. And it pushes out the $1 million goal to three months after you have turned 69 years old (see below).

Do you see how powerful compounding interest can be? Just think about how this can affect a loan. It is important for us to know these things so that we can try to plan as best as we can. Things come up and life can get in the way, but building a strong foundation of financial education can really help us excel in the world. I read somewhere recently that something like 99% of Warren Buffet’s wealth came after he was 50 years old and I think around 90% came after he was 65 years old. This is a real life example of compounding interest. Buffet’s game is stocks though and he has committed to it – investing in stocks since he was just a young man.

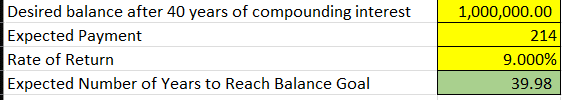

I want to present you with the two downloads below. One is in Excel, one in Google Sheets. I provide both because I think Google Sheets is free and some might not have Excel. But use the downloads. The Example by Month will show you a monthly break out on compounding interest. You can play around with it to see just how compounding interest affects your monthly deposit amounts and how quickly that balance can grow – especially if you add in some extra to your deposits here and there. The Example by Formula worksheet is summary sheet that you can play around with to see how the various inputs interact with each other when we compound interest. For example, if you look at the below, notice that a desired balance after x number of years is $1 million dollars and we expect to contribute $214 monthly with an assumed, but not realistic, constant rate of return of 9%, we get the expected number of years to be close to forty. This checks out to the above.

I hope that these Excel and Google Sheets worksheets are useful. I believe that being able to see the math that goes into these various finance concepts are critical to building that strong financial education foundation and giving us the confidence to engage with professionals in the field.

Disclaimer: I am not a financial advisor. The content on knowxchange.com or “this site” are for educational purposes only and merely cite my own personal opinions and experiences. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!